cxcPublic Limited Company

Public Limited Company

Have Doubt!

Clear In A Minute.

How Its Works

1. Select service

Select the service read

the details.

2. Call to discuss.

Our expert will connect \with you & prepare documents.

3. Pay By COD.

Submit all the Documents & Pay the amount.using COD.

4. Get Documents.

Get your serve done & your

document deliverd.

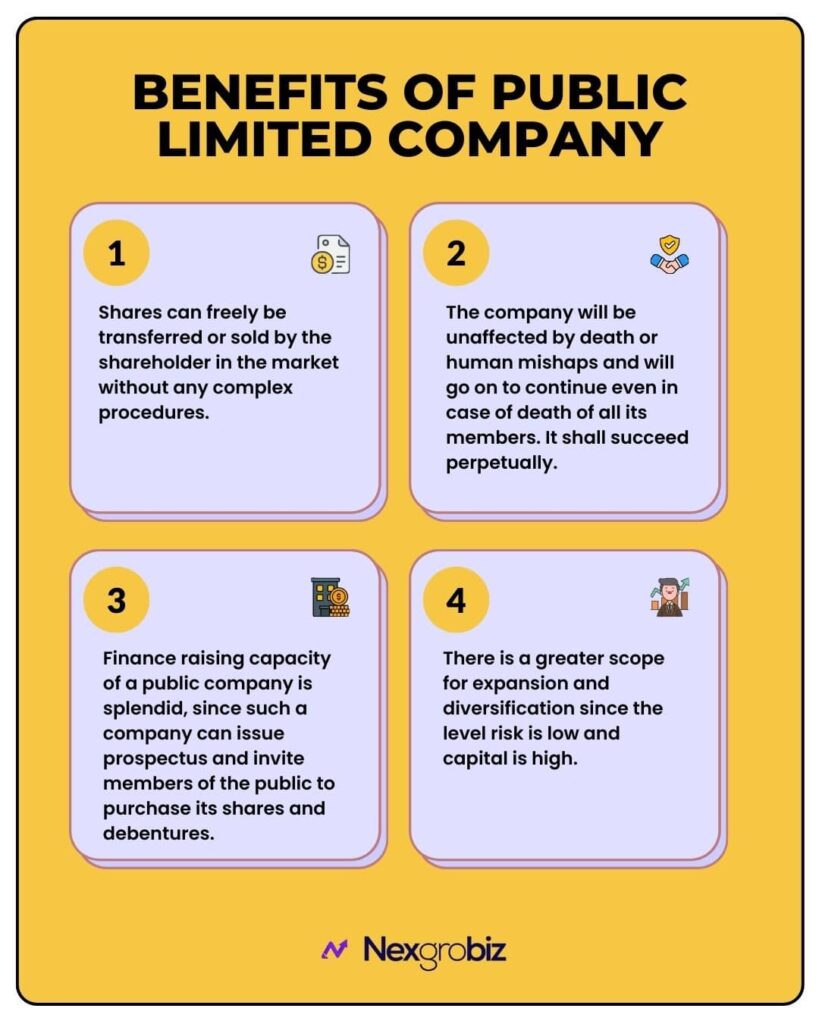

Benefits of Public Limited Company

Shares can freely be transferred or sold by the shareholder in the market without any complex procedures.

Risk is spread between the huge base of shareholders, making the functioning of the company smooth and easy.

There is a greater scope for expansion and diversification since the level risk is low and capital is high.

Finance raising capacity of a public company is splendid, since such a company can issue prospectus and invite members of the public to purchase its shares and debentures.

The company will be unaffected by death or human mishaps and will go on to continue even in case of death of all its members. It shall succeed perpetually.

Limited Liability exists as against the shareholders of the company. Once the shareholder has paid has paid up his maximum liability, no matter how heavily a company runs into debt, the liability is that of the company and not of the shareholders.

Minimum Requirements For

Public Limited Company

Minimum 7 members are required for its incorporation, and no maximum number is provided under the Companies Act.

Minimum of 3 directors are needed for the company to start operating.

Such directors should be individuals and should hold a Director Identification Number (DIN).

Digital Signature Certificate (DSC) of one of the directors is required.

After the amendment of 2015, no minimum paid-up capital is required, it should be as prescribed.

An address of the company for correspondence until the registered address is established is necessary.

Name of the company should be selected and must be unique, compliant with laws. An application for Reserve Unique Name (RUN) has to be made with the Ministry of Corporate Affairs (MCA) on its portal for the approval of the name.

After the name gets an approval, an application has to be submitted with the Registrar of Companies (ROC) along with Memorandum of Association, Articles of Association and the incorporation form (SPICe). Payment of prescribed fees to ROC is also necessary.

An affidavit by each of the named people stating that all the documents to ROC for registration contain information that is correct, complete and true to best of their knowledge and belief is required.

Documents required for

Public Limited Company

Scanned copy of PAN card or passport (foreign nationals & NRIs)

Address Proof i.e Aadhaar Card/Voter Card/Driving License etc.

Residence proof of Director i.e Bank Statements, Electric Bill, Phone Bill etc

Nominee Identity Proof, Address Proof & Residence Proof Required

registered office address Required that can be rented or owned.

Scanned passport-sized photograph specimen signature (blank document with signature [directors only])

Document Required For Rented Property Rent Agreement, Latest Electric Bill/Gas Bill/Phone Bill and No Objection Certificate take From Owner.

Document Required for owned Property Sale Deed/Property Deed Latest Electric Bill/Gas Bill/Phone Bill and No Objection Certificate Consent Letter.

Registration Process (steps) for

Public Limited Company

The first thing that you have to send an application for Digital Signature Certificate (DSC) of all Directors and Shareholders.

You will then have to apply for the Director Identification Number or DIN.

Then our experts will apply your choice Business name for getting approval from MCA.

Then our experts drafting your Document like DIR-2, MOA, and AOA etc.

After getting the entire Document correct our Experts Finally Apply on MCA for company registration.

Then you will get your Certificate within 3-4 Business Days subjected to choosing yours Payment option (i.e Online payment or COD).

How Nexgrobiz can help

you with your Public Limited Company?

Let's Clear All The Doubts!

Identity proof of all the shareholders and the directors; Address proof of all the shareholders and the directors; Passport sized photograph of directors; PAN Card of all the shareholders and the directors; Utility bill of the proposed office that is to be treated as Registered Office of the Company; A copy of rent agreement, if the property is rented of the proposed office; No-Objection Certificate from the landlord of the proposed Registered Office; A copy of property papers, if the property is owned of the proposed office; DIN of all the directors; DSC of one of the directors; Memorandum of Association duly signed by the subscribers in the prescribed manner; Articles of Association duly signed by the subscribers in the prescribed manner

The online process is fairly seamless and hence it may take as few as 7 days, if there are no hiccups or mistakes made.

Once all the requirements are complied with, the members cannot start the business until the declaration is made with regard to the subscription money to be paid in 180 days by the directors.

After the 2015 amendment, there is no minimum capital requirement.

It shall be reserved for 20 days from the date of approval in case of the name being reserved for a new company, and 60 days for a change in name of an already existing company.